Information checkedInformation unaudited Information geprüft Information ungeprüft New fee model in asset management

On 1 January 2024, we became the first bank in Switzerland and Liechtenstein to introduce the high-water mark for our performance fee model in asset management (LLB Comfort). Clients affected by the changeover were informed in the fourth quarter of 2023.

Most banks offer performance fee models. In many cases, these models do not use any reference value, so clients have to pay the performance fee every time the investment performs well – regardless of whether the portfolioʼs peak has been exceeded or not. After a price slump, it makes no difference whether the original performance value has been reached again or not.

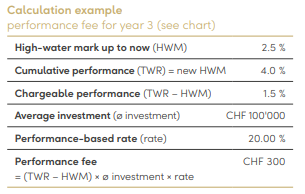

How does a performance fee model work in asset management?

The performance fee model consists of two components:

- a basic fee with a reduced rate is charged each quarter on the assets under management to cover the basic administration and management costs, and

- a performance fee is charged once a year, payable as soon as the value of the portfolio increases due to good asset management (positive performance), the fee model is changed, or a portfolio is closed.

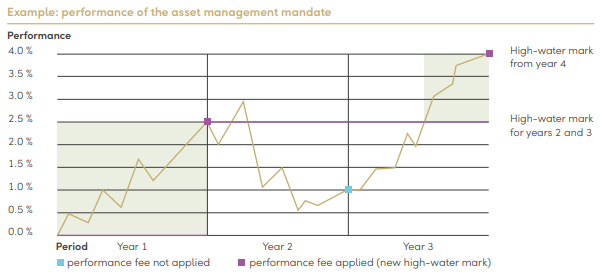

What is a high-water mark in this context?

Like a high-water mark for a body of water, the high-water mark in investing is a reference value stored in Avaloq that indicates the historically highest performance level (cumulative return) of a portfolio. With the introduction of this model, the cumulative performance as at 1 January 2024 was set as the high-water mark for all clients using the performance fee model.

How do our clients benefit from the high-water mark?

Using a high-water mark as a reference indicator for our success in asset management, our clients benefit from a fairer fee structure. Previously, positive performance was subject to a fee even after a previous negative development of assets, e.g. due to price losses. This meant that the client may have had to pay a performance fee several times for any returns generated.

Using a high-water mark, a client pays a performance fee only if the performance has developed positively compared to the historical peak. If the performance remains below the high-water mark, the performance fee is waived and the client pays only the basic fee rate. In the medium and long term, depending on market performance, our clients save with this fee model.

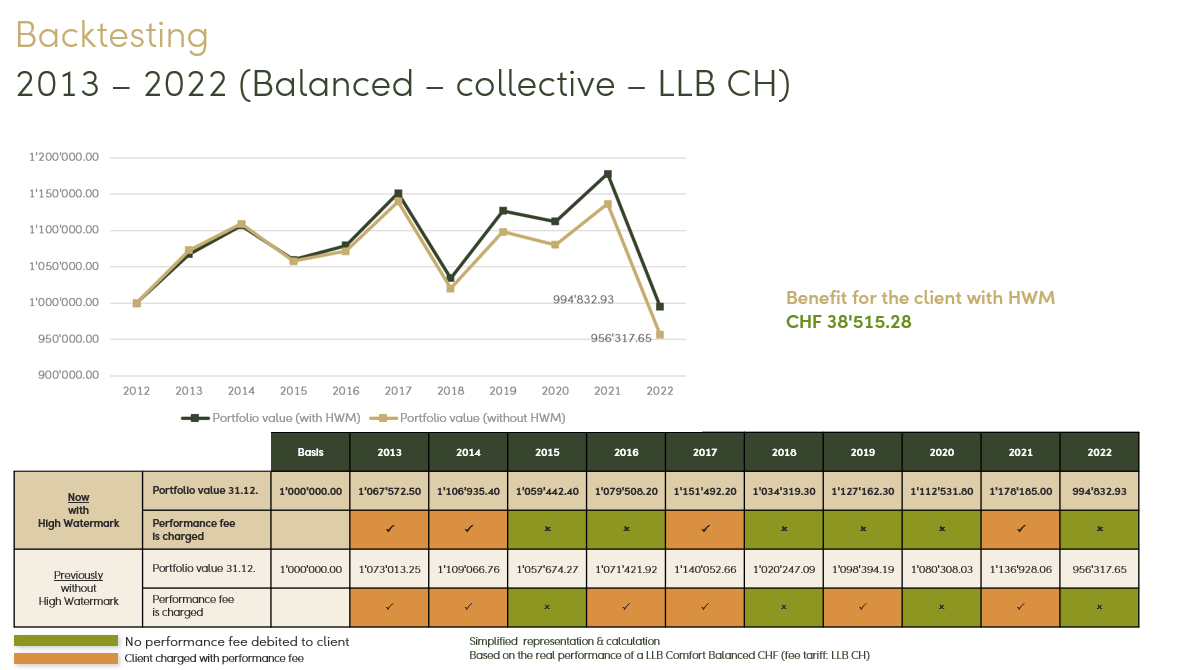

Whether our clients save in practice was checked through backtesting, using a simplified fee calculation. Both the previous fee model and the high-water mark fee model were applied and compared for sample portfolios for the years 2013 to 2022.

LLB employees with a performance-based direct investment mandate in asset management (50 % discount on client rate) also benefit from this adjustment, of course. An asset management mandate with collective investments is free of charge for employees anyway.

How does the LLB benefit from this new model?

By introducing this new model, we have taken the opportunity both to revise our pricing and to standardise the different fee rates between the LLB in Liechtenstein and in Switzerland.

The clear main benefit from the LLBʼs point of view is that the performance fee model with the high-water mark is a more attractive pricing model for our clients, reflecting our values of integrity and respect for the client.

Moreover, this fee model is future-proof, given the expected expansion of an EU guideline on performance-based remuneration for investment funds to performance fee models in asset management.