Information checkedInformation unaudited Information geprüft Information ungeprüft A perfect match: LLB Österreich on a growth path with the acquisition of Zürcher Kantonalbank Österreich

In this interview, Robert Löw, CEO of LLB Österreich, shares insights into the strategic acquisition, market opportunities, and the crucial role of employees.

Robert Löw took the time to delve into the details of LLB's acquisition of Zürcher Kantonalbank (ZKB) Österreich. We asked him how this acquisition supports LLB's growth and the opportunities it brings. The passion and commitment of employees play a vital role.

How did LLB decide to buy another bank?

Growth is a key element of our ACT-26 strategy. We aim to grow both organically and through targeted acquisitions. Austria has long been a home market for the LLB Group, and LLB Österreich specialises in private and institutional banking. ZKB Österreich is a perfect match for our focus on Austrian private banking clients with discretionary asset management.

How does the acquisition affect the market position of LLB Österreich?

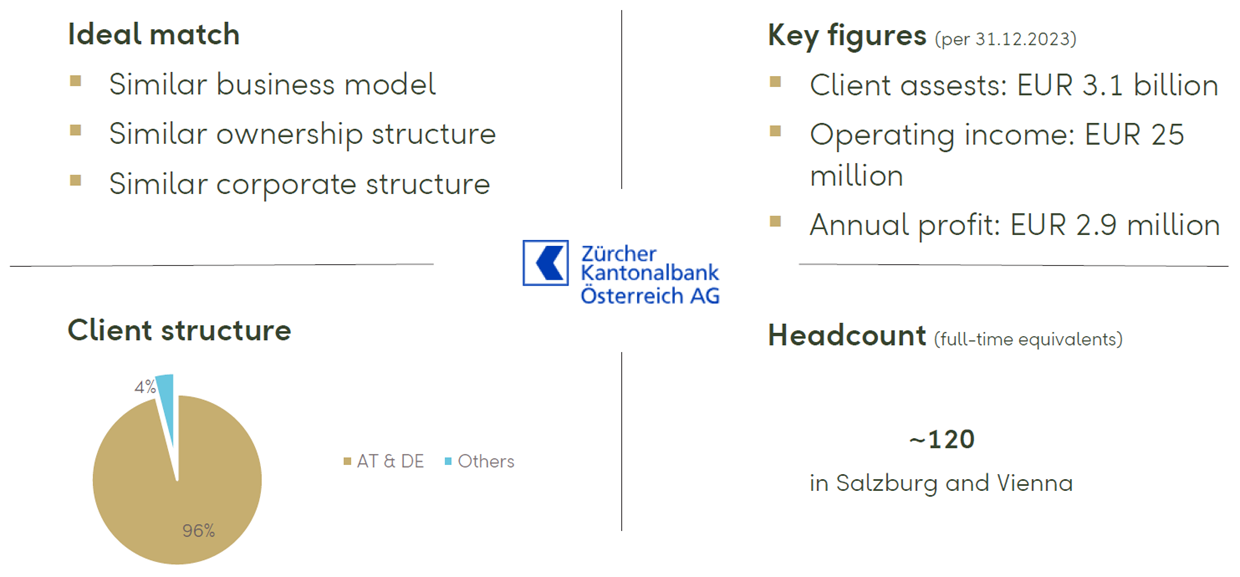

With a business volume of EUR 32 billion in 2023, we are already one of the largest asset management banks in Austria. The additional EUR 3 billion from ZKB Österreich further solidifies our number one position. Our successful Salzburg office will make significant strides in Western Austria with the integration of the new team from ZKB Österreich, which is headquartered in Salzburg.

What are the advantages and opportunities of this acquisition?

The business volume under management in private banking now reaches the EUR 10 billion mark. Our increased presence in Western Austria opens up new, attractive client regions. The additional asset management expertise enriches our investment capabilities even further. With only two foreign private banking providers remaining on the market, we see additional opportunities. We are particularly pleased to welcome competent and experienced colleagues who will fit in well and contribute to our success.

What impact does this acquisition have on our growth strategy?

This is the third M&A transaction in Austria in six years, following the takeover of Semper Constantia Privatbank and the referral deal with Credit Suisse Austria. So far, these transactions have been very successful – knock on wood that this one will be as well! After this, we'll see what new opportunities arise in the Austrian market.

What are the short- and long-term goals of the acquisition?

In the short term, our goal is to win over the clients and employees of ZKB Österreich and integrate them as smoothly as possible, minimising disruption to business operations at both banks. We also need to merge two banking systems – a recurring challenge. Fortunately, we are familiar with ZKB Österreich's banking system, as it is the same as that of Semper Constantia Privatbank and the former LLB Österreich, which we migrated to our LLB system five years ago.

In the long term, we aim to further expand our position as the number one asset management bank. With the withdrawal of most foreign private banking providers, only two Liechtenstein banks now offer Austrian clients a strong alternative to domestic banks. This should increase the share of assets invested with us.

What does the purchase mean for the employees of LLB and ZKB Österreich?

First and foremost, the LLB Group's investment in Austria demonstrates a clear commitment to the Austrian market and to LLB Österreich – and by extension, to our Austrian colleagues. Through the end of 2025, we need the dedication of all employees from both banks to ensure a successful merger of the two institutions and their banking systems. After that, we can begin to realise the potential synergies.

How did employees react after the purchase was announced?

For the employees of ZKB Österreich, the sale came as something of a surprise, and many needed time to process it. However, the reactions to LLB as the new owner were overwhelmingly positive, with some employees even describing LLB as their preferred buyer. A cantonal bank and a Landesbank share similar cultures, which makes for a good fit.

The employees of LLB Österreich also responded positively and supported this logical step in our growth.

What role do employees play in the successful integration of the two banks?

Employees play the most important role. Conviction, passion, and a willingness to go the extra mile are the key ingredients for success among our colleagues at both banks. As the Board of Management, we will again actively participate in the integration committee and support the process every step of the way. We look forward to this journey!

)

)