Information checkedInformation unaudited Information geprüft Information ungeprüft Into the digital future with LLB.ONE

CHF 100 million will be invested in the LLB Group's digital transformation by 2026. What led to the creation of such a comprehensive digitalisation programme?

Let's pause for a moment and imagine the world before smartphones, the internet, and online banking. Back then, we would visit a bank branch for any banking transactions – whether it was to change our address, apply for a loan, or withdraw cash. All communication happened through personal conversations or phone calls, and documentation was physically filed in folders.

Digitalisation has fundamentally transformed our world. Processes that once took days can now be completed in minutes. Our lives have become faster and more digital, and this evolution continues. This shift not only changes our personal lives but also has a lasting impact on companies. This is where LLB.ONE comes into play.

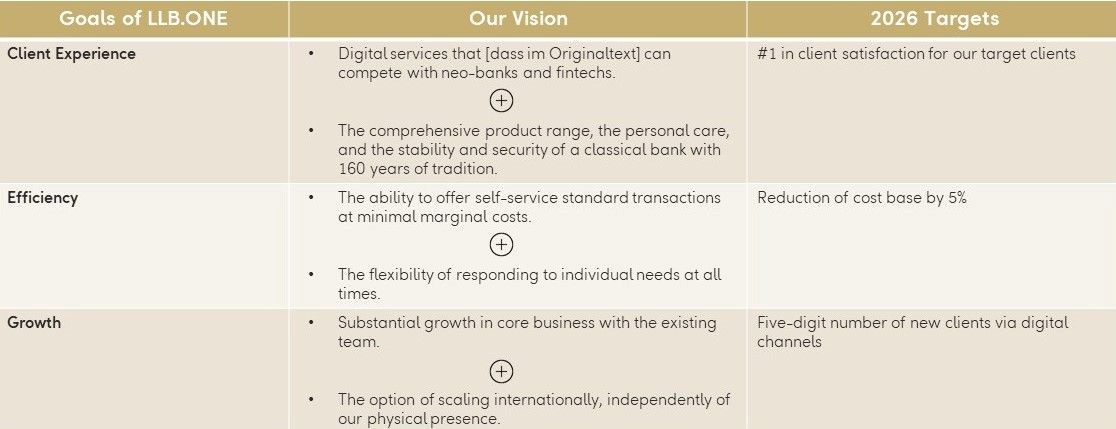

Target vision of LLB.ONE

When the ACT-26 strategy was introduced two years ago, the LLB.ONE programme was launched at the same time. The aim of LLB.ONE is not just to optimise existing processes but to fundamentally rethink them in order to sustainably increase the efficiency of our bank. To consistently advance the bank's digitalisation, LLB.ONE follows these approaches:

- Focus on end-to-end processes – from the client interface to settlement.

- Omni-channel digitalisation – not just online/mobile and self-service, but across all channels right through to physical client meetings.

- Group-wide – all client segments and regions.

In short: LLB.ONE makes us a more efficient and client-oriented bank. We are enhancing efficiency in our core business through the targeted use of new technologies, while also providing our clients with personalised solutions. This means that banking is also possible via purely digital channels, such as wiLLBe.

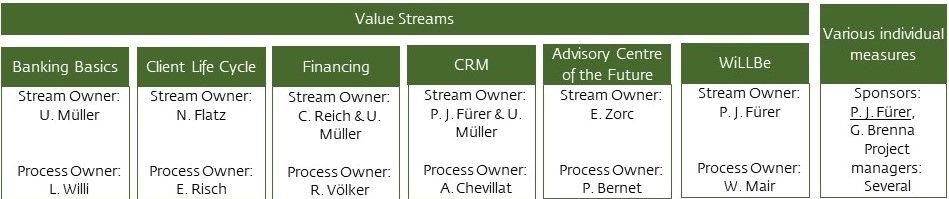

LLB.ONE Value Stream

Initial successes and implementations

Here is a brief overview of some successful implementations:

- Mobile Payments: Introduction of Apple, Samsung, and Google Pay for Visa debit cards and TWINT for LLB Schweiz.

- Online renewal of mortgages: Enabling online renewal of existing mortgage products and product changes up to twelve months in advance.

- Client Life Cycle: Introduction of over 20 new functionalities (W-8BEN update, account closure, identification process in digitally supported advisory services).

- Digital adoption: Creation of a dashboard on the use of e-banking and measures derived to increase usage.

- HR joiner process: Improving technical onboarding for new hires and increasing the degree of process automation.

- e-tax statement: Digitisation of the Swiss tax statement, which can be imported directly into the cantonal declaration software.

- Digital cross-border transactions: Digitalisation of the information and compliance process for cross-border business.

- New account packages: Introduction of the new LLB Daily package range with three simple and clearly structured packages.

- Salesforce: Launch of the CRM system for Direct Clients Switzerland and Liechtenstein.

- Digitales onboarding: Implementation of digital onboarding with digital signature and digital identification for our EAM end customers with booking location Liechtenstein.

- wiLLBe: Introduction of wiLLBe overnight money and wiLLBe term deposits.

- Beratungscenter der Zukunft: Design and implementation of appointment callback, piloting of SMS appointment information, optimisation of digital advisory services.

Looking ahead

Over the past 2.5 years, we have laid important groundwork and reached significant milestones. But there's more to come – here's what's planned for the coming months:

- Financing: E2E credit process (corporate clients/individual, new business)

- Client Life Cycle: expansion of digital onboarding

- CRM & Advisory Centre of the Future: Expansion of Salesforce in advisory centre, Private Banking, introduction of Marketing Cloud.

- Hybrid Mobile: Roll-out and follow-up topic Hybrid Online

- wiLLBe: Further growth and introduction of wiLLBe Gold

- Banking Basics: Expansion of LLB Daily for further client groups and extension of relevant self-services

We are all still challenged to shape the digital future of our bank. With LLB.ONE, we are ensuring that we will continue to be a competitive and dynamic employer in five, ten, and more years, remaining an attractive bank for our clients.