Information checkedInformation unaudited Information geprüft Information ungeprüft LLB Schweiz: Organisational adjustment

In May of last year, the strategy for the Swiss market was announced for LLB Schweiz. In May of this year, LLB Schweiz employees were informed of the next steps in the implementation of the strategy: The sales organisation will be set up efficiently in line with the strategic orientation. The reorganisation affects the Retail & Corporate Banking division within LLB Schweiz with its Private Banking, Corporate Clients, and Direct Clients business areas. We spoke with René Zwicky, CEO of LLB Schweiz, about the background to this reorganisation.

René, youʼve been CEO of LLB Schweiz for almost six months now. What experiences have you already gathered?

Whatʼs new for me is always being in the spotlight. My new “label”, CEO of LLB Schweiz, means that I receive many external enquiries that have to be responded to very quickly and in a targeted way, but that also have to be prioritised. And above all, this means taking advantage of the right opportunities and involving the right contact persons.

A year ago, LLB Schweiz announced its plans for the Swiss market – what has happened since then?

We have been able to recruit experienced and motivated employees in the Zurich and Eastern Switzerland markets who are eager to make our exciting brand even better known and more successful. We have also recently communicated some organisational adjustments, so that we can respond in an even more targeted way to the needs of our clients and position ourselves even more successfully for the future.

In May, you announced the new organisational structure of LLB Schweiz. What does it look like?

We are combining Private Banking into a single segment, providing our clients with even more needs-oriented support in the form of mortgage financing experts, strengthening the regions with qualified direct client advisors on site, and focusing on the main needs of our clients in the core segments with the expertise of specialist advisors.

By adapting our structures, we can use our resources more effectively.

How is this new structure aligned with our strategic goals?

We are focusing on the core needs of our clients in the growth segments of Corporate Clients and Private Banking, relying on the strengths and skills of our employees.

In the important foundation of our banking business, Direct Clients, we are increasing our local advisory expertise at our banking locations, making ourselves more visible and closer to the market. We are still very happy to advise more digitally savvy clients from our central location in Uznach.

With this structure, we are also demonstrating our clear commitment to the regions and locations already communicated. We are progressing in an evolutionary – not a revolutionary – way, developing in the direction of the performance promises we have made in the individual segments.

What are the next steps over the coming months in terms of strategy implementation?

Opening and increasing our presence in the Zurich and St. Gallen markets, implementing recruitment in the EAM business after our final definition of the target markets, and implementing organisational adjustments in the core regions.

Implementation starting 1 July 2024

In each client segment, the focus is on the respective core competencies: in Private Banking on investments, in Direct Clients on basic products and standard investment products, and in Corporate Banking on liquidity management and corporate financing. These segments are supported by teams of experts, including specialist advisors for loans, investment advisory services, portfolio management, and financial planning.

In our Direct Client business, clients can choose between consultation in person, by phone or e-banking, and self-service.

In concrete terms, this means:

- The Private Banking I and Private Banking II departments will be merged under “Private Banking”.

- A new “Financing Experts” team will be created to manage all loans from the Private Banking and Direct Clients business areas.

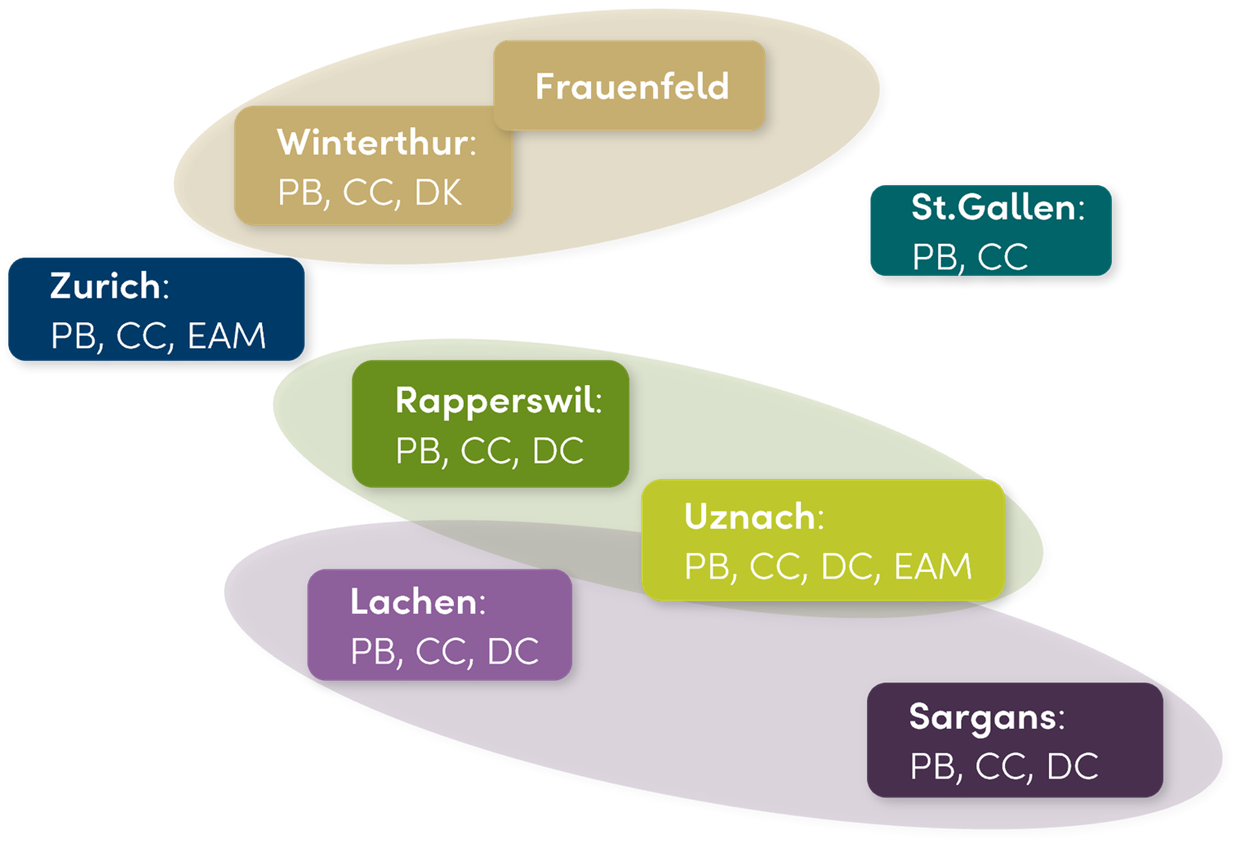

- The banking locations will be grouped into five management regions:

- Zurich region

- Winterthur / Thurgau region

- St. Gallen region

- Obersee / Linthgebiet region

- Ausserschwyz / Sarganserland region

- At each banking location, one person will be appointed as location manager who, in addition to their role, will be responsible for LLB representation and market presence at the respective location.

- At the locations in Uznach, Rapperswil, Sargans, Lachen, and Winterthur, Direct Client advisors will provide on-site support for walk-in clients.