Information checkedInformation unaudited Information geprüft Information ungeprüft Behind the scenes: LLB Daily project

LLB Daily was successfully launched in Liechtenstein and Switzerland on 1 January 2024. Youʼve been able to follow the intensive preparations for go-live, especially in sales, on the intranet. Before go-live, broad knowledge was built up internally, a training page was designed, six videos were made, FAQs were drawn up, work instructions and a package calculator were made available. But how is a project like this set up, and what all needs to be done?

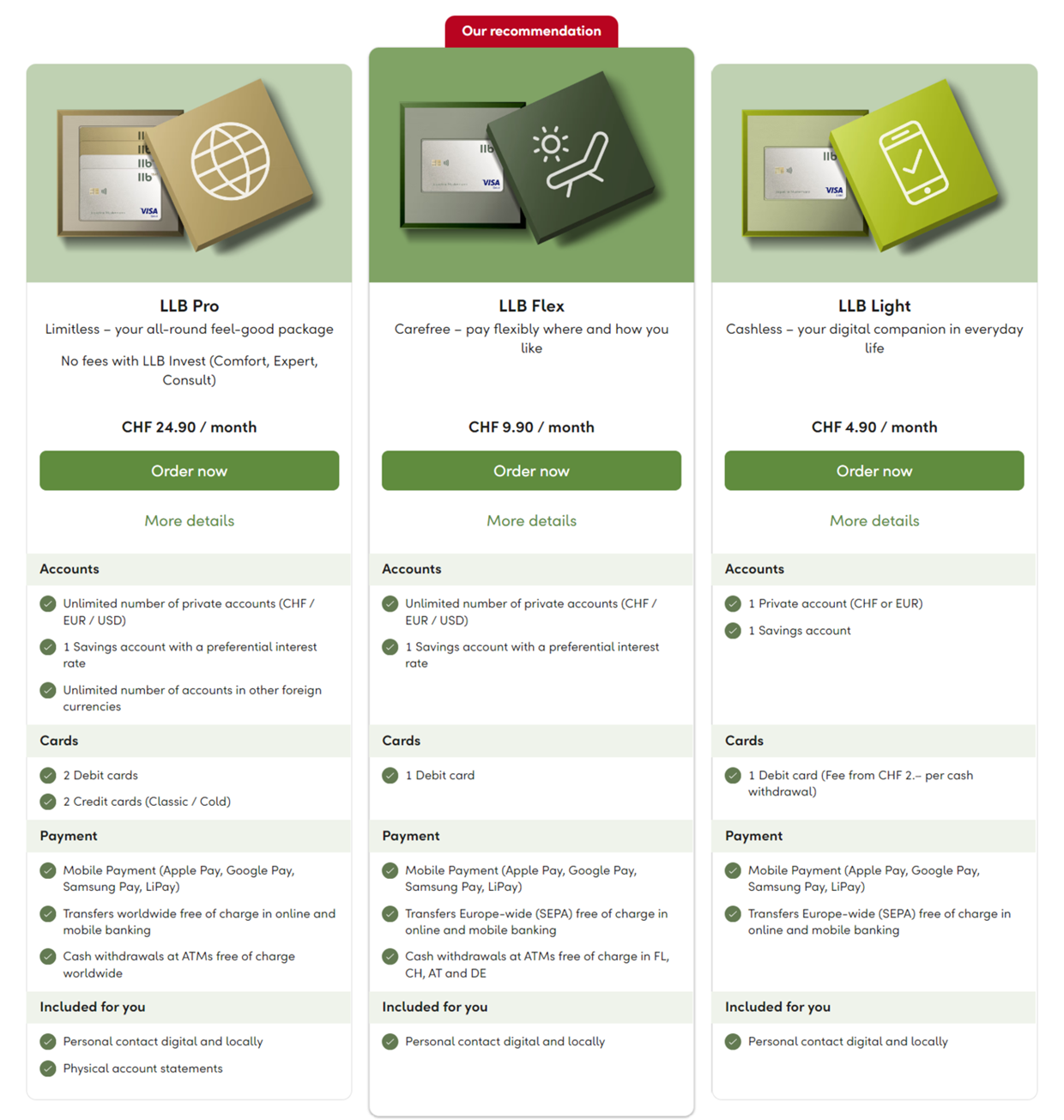

The previous Combi packages have been replaced completely by LLB Daily. Introducing such a product for more than 70,000 clients at two banks at the same time is very complex, requiring many different people and partners to work together in a coordinated manner. We would like to illustrate this with three examples that give you a small glimpse behind the scenes of the work in the One Basic Banking Value Stream over the past few months.

Cooperation is the thorough conviction that nobody can get there unless everybody gets there.

Virginia Burden

Client information

In November last year, our clients received information about the introduction of our LLB Daily packages. Work on the client letters began already in spring 2023 with the identification of the client groups. An individually tailored letter was formulated for each of the 20 groups. These texts were finalised in close collaboration with Marketing, Sales, Product Management, and Pricing. All clients received the letters in their chosen correspondence language. All letters were translated into English, French, and Italian, even though most communication was in German. Our IT department was responsible for the layout and dispatch of these client letters. Based on the information about which client should receive which letter, groupings were created in Avaloq. A new logic had to be implemented so that the digital channels were prioritised for dispatch and, where possible, clients were not contacted more than once. As a team, we had two special challenges to manage in this context: having the clientʼs current address data available on the mailing date, and the proximity in time to the rebranding. We managed both of these challenges well, so that our clients in Liechtenstein and Switzerland received the changeover information as planned in six mass mailings. At the same time, the official LLB Daily website went live.

Information in Online Banking

The new Online Banking pages were activated for our clients at the end of 2023 / beginning of 2024. In addition to a new package overview, we are offering self-service for the Daily packages for the first time. The path to the new Online Banking pages was challenging and many-layered. Initial impulses for the page design were supported by the specialised consulting firm SKP. Many discussions and considerations not only within the core team, but also external tests led to the decision in favour of an implementation option, which was then further refined. The necessary new web components were built by our partner Avenga in Berlin. One of these new components is the highlight table, which you probably already know well.

Our IT department integrated the new components into the website and Online Banking and adapted the Online Banking/Avaloq interface to ensure full functionality. We were supported by our external partners Ergon (Online Banking, interface) and Uniq (adaptation of components for the website). Complex coordination was required before all components could be implemented and fully tested. In Avaloq, for example, we had to ensure that when a client uses self-service to change a package, the Fee Designer triggers a daily fee statement and a correct voucher is created. This was challenging, given the limited availability of the test environment (Avaloq and Online Banking).

Further challenges

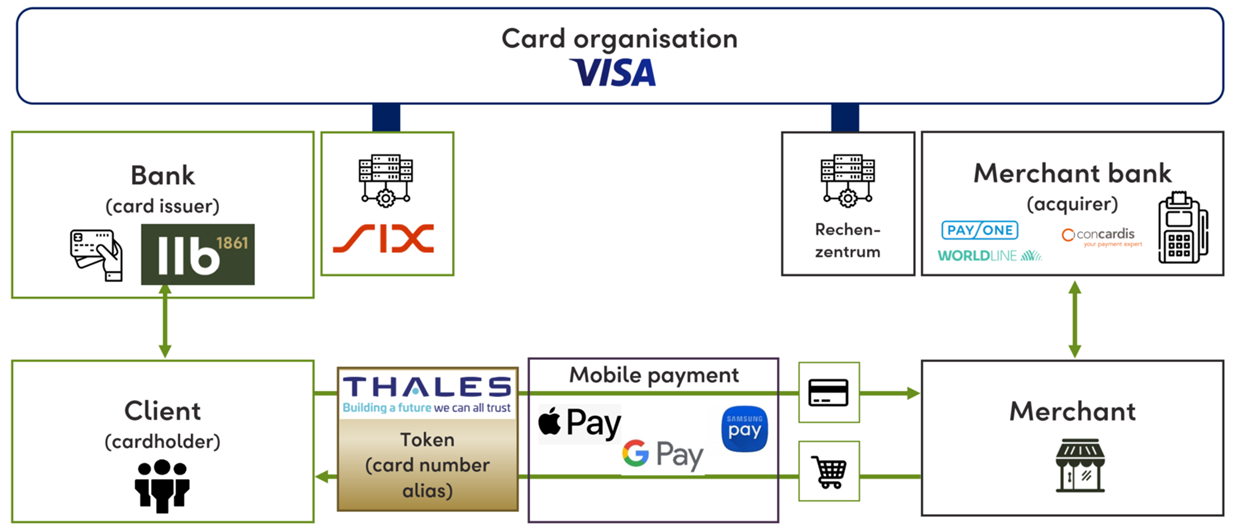

But there were also other kinds of challenges. Mobile payment options – so that clients no longer have to carry a physical debit card – go without saying these days, and they are a strong argument in favour of our Daily packages. To the end client, it sounds simple: Activate the desired payment service, activate the card, and use it right away. That canʼt be too difficult, can it? But none of this is possible without contracts: In addition to a licence agreement with the card issuer Visa and a contract with the card processor SIX, a contract must also be concluded with the payment provider (Apple, Samsung, or Google). A further external service provider generates the card number alias. An alias is essential for security reasons to ensure that no critical card data is stored on servers. Only once all the contracts have been concluded can the technical connection be established.

And of course, before activating a payment provider for our clients, we tested it extensively in a “family & friends” test phase. With so many parties and systems involved, there is always a residual risk of small, unforeseen initial difficulties. For example, many Liechtenstein clients have the country setting “Switzerland” on their mobile phones, and the LLB (Liechtenstein) did not appear in the selectable list of banks.

Thanks to intensive cooperation and communication, we were able to master the challenges in the One Banking Basics Value Stream and achieve our goal: to offer our clients modern, need-oriented basic banking packages with LLB Daily.